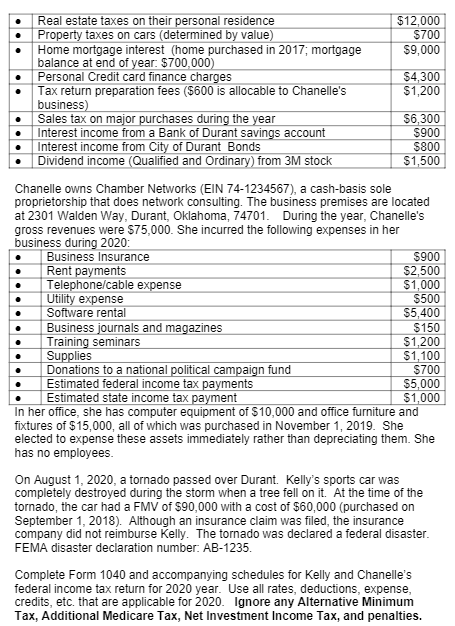

net investment income tax 2021 form

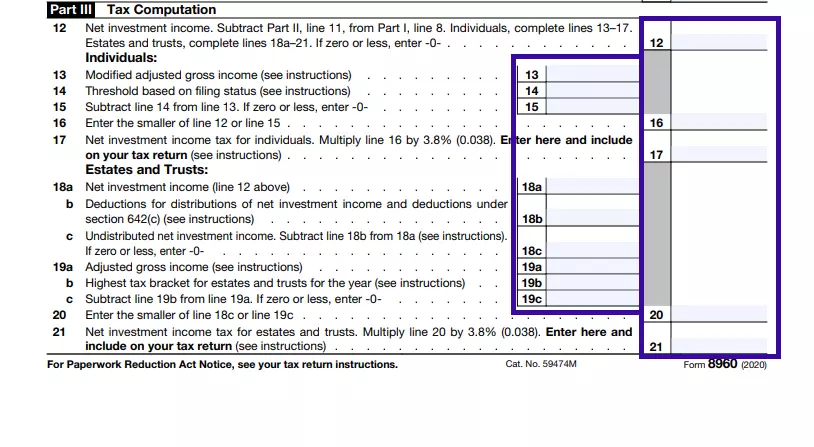

2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal. More about the Federal Form 8960 Other TY 2021.

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

1 It applies to individuals families estates and trusts.

. April 28 2021 The 38 Net Investment Income Tax. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. UseForm 8960 Net Investment.

NIIT is a 38 tax on the lesser of net investment income or the excess of the childs modified adjusted gross income MAGI over the threshold amount. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified adjusted gross.

More about the Federal Form 8960 Other TY. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. Generally net investment income includes gross income from interest dividends annuities and royalties.

The tax explained. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. April 8 2021 756 AM.

All About the Net Investment Income Tax. The total of your Net. All of your 20000 Net Investment Income is subject to the NIIT.

Subtract the MFJ threshold of 250000 from your MAGI of 300000 resulting in 50000. Include state local and foreign income taxes you paid for the tax year that are attributable to net investment income You can determine the portion. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with considerable.

The estates or trusts portion of net investment income tax is calculated on Form. Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers. We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960.

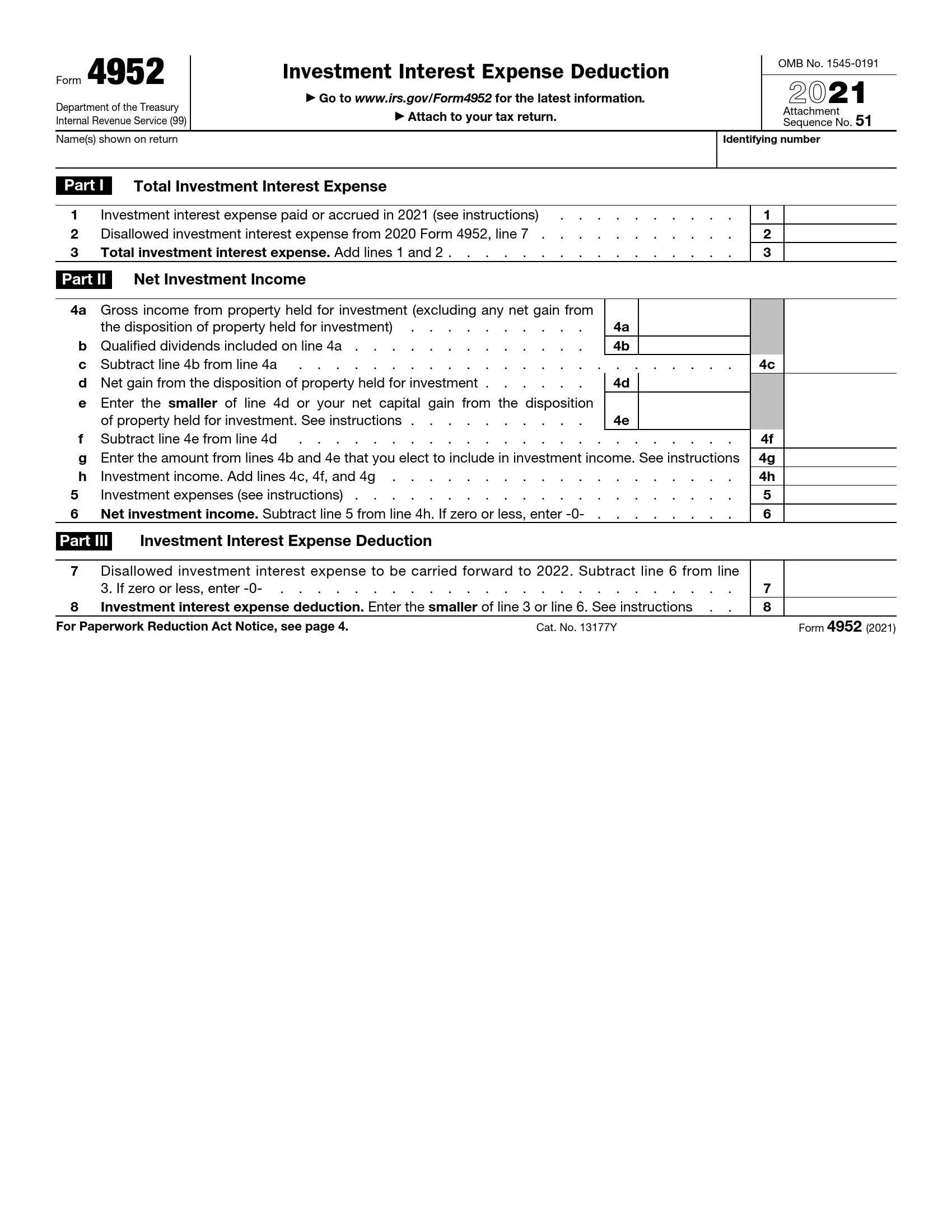

California election to include net capital gain tax forms are a summary of California tax TAXABLE YEAR 2021 Investment Interest Expense Deduction CALIFORNIA FORM 3526 Attach to Form. Special rules apply for certain unique types of trusts such a Charitable Remainder Trusts and Electing Small Business Trusts. In 2021 this threshold amount is 13050.

For estates and trusts the 2021 threshold is.

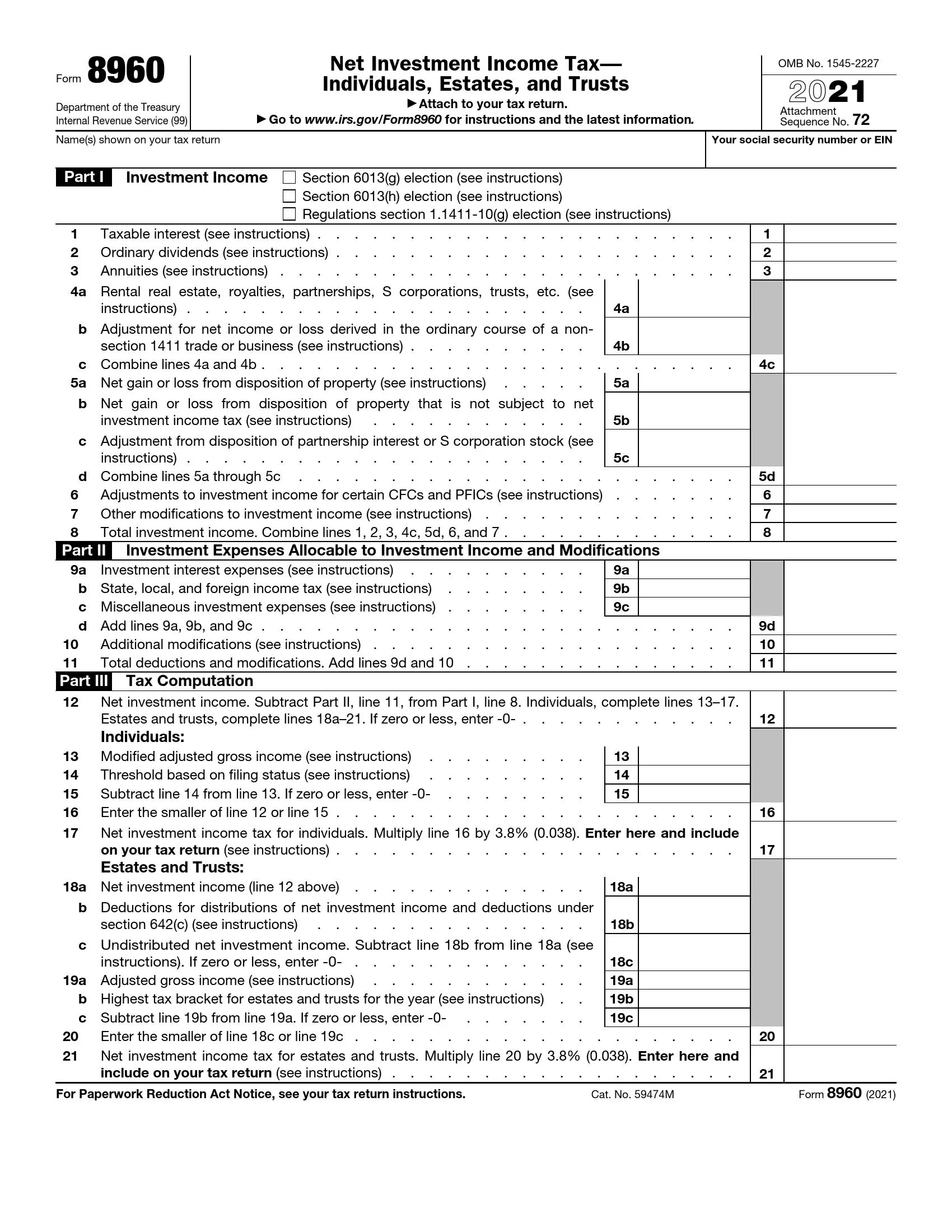

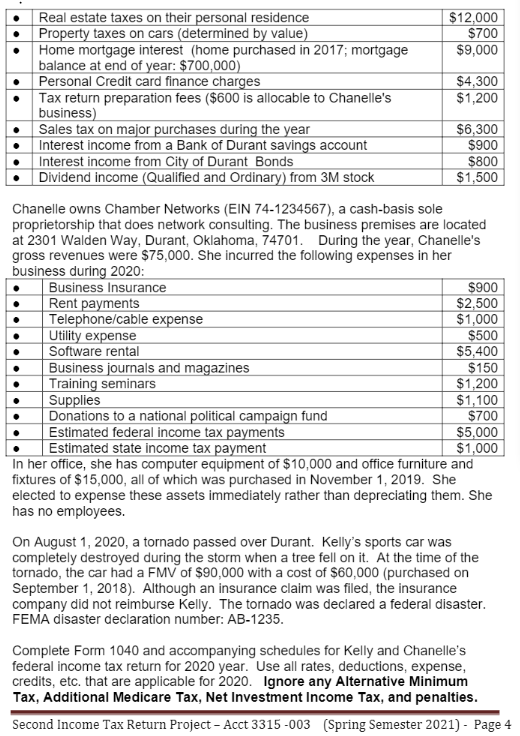

Income Tax Return Project 2 Spring Semester 2021 The Chegg Com

Irs Form 8960 Fill Out Printable Pdf Forms Online

Problem 11 61 From 2021 Book Prepare 2020 Return Chegg Com

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

The Following Facts Are Available To Help Prepare Chegg Com

What Is The The Net Investment Income Tax Niit Forbes Advisor

Irs Form 8960 Fill Out Printable Pdf Forms Online

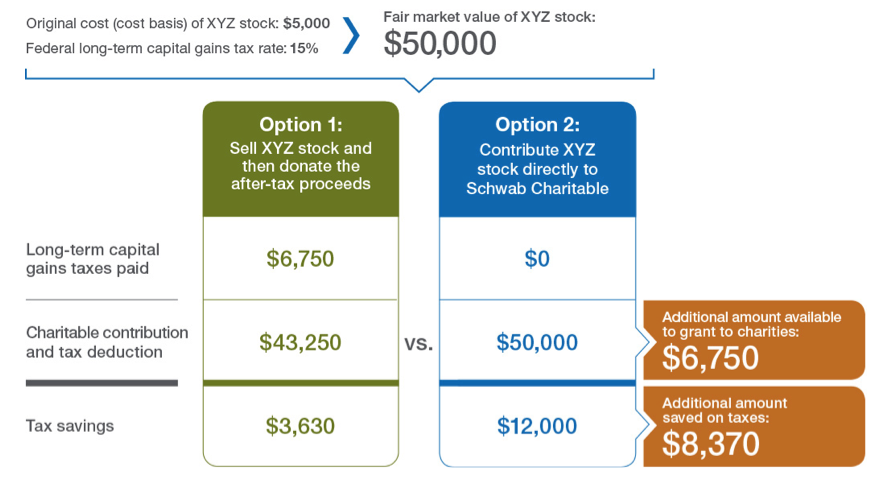

Four Ways To Help Clients Maximize Charitable Giving Impact In 2021

Publication 929 2021 Tax Rules For Children And Dependents Internal Revenue Service

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Irs Form 4952 Fill Out Printable Pdf Forms Online

The Impact Of The American Families Plan Strategies Wealth Advisors

Investment Expenses What S Tax Deductible Charles Schwab

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Net Investment Income Tax Niit Quick Guides Asena Advisors

8960 Net Investment Income Tax 8960 K1 Schedulec Schedulee Schedulef

Top Irs Audit Triggers Bloomberg Tax

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe